Core business activities and operational overview

Maritime container transportation

FESCO provides domestic, export, import, and transit container transportation services and is the leader in shipping containers from Southeast Asian countries to Russia via the Far East. We also offer integrated services to transport dangerous, oversized, less‑than‑container‑load (LCL), and general cargo along with special equipment. The Group operates 17 international and domestic sea routes, with its transportation geography spanning over 110 ports globally.

2024 achievements in the international transportation segment:

- to increase capacity on one of its most busiest routes, the Company introduced a new FESCO China Direct Line‑5 (FCDL‑5) as part of its FCDL line, establishing a direct connection between Shanghai and VMTP, with a transit time of three days and weekly sailings;

- the Company launched the FESCO Intra Asia Service (FIAS) between Vietnam and Malaysia, marking its first shipping service in nearly two decades that does not call at Russian ports. This route was designed not only to facilitate local container transportation between Vietnam and Malaysia, but also to serve as a feeder line transporting additional cargo volumes between Malaysia and other Southeast Asian and Indian subcontinent countries (including Sri Lanka, Singapore, Bangladesh, India, Indonesia, and Thailand) and Russia. Containers are transshipped in Ho Chi Minh City onto other vessels of the Group’s vessel fleet operating on the FESCO Vietnam Direct Line, which links Vietnamese ports with VMTP;

- FESCO significantly expanded the FESCO Baltorient Line (FBOL) connecting ports in China, India, and St Petersburg, shipping over 75 thousand TEU – nearly triple the 2023 volume. In 2024, the Company added direct port calls at China’s Dalian and Qingdao, as well as South Korea’s Busan. The same year saw the deployment to this route of the final vessel in a series of six modern container ships built for FESCO at a Chinese shipyard;

- the FESCO Indian Line West (FIL‑W) service between Indian ports and Novorossiysk handled over 16 thousand TEU – a tenfold increase over the previous year. This exponential growth resulted from intensified maritime shipping between the countries and expanded fleet capacity on the route. Furthermore, in September 2024, the Group added regular direct calls at Jebel Ali Port (UAE) to the FIL‑W route, and in December, initiated container transportation between Novorossiysk and Mombasa Port (Kenya) as part of the FIL‑W service. Russian exports are routed through the Mundra transshipment port (India), while Kenyan imports transit via Jebel Ali;

- FESCO launched the enhanced FESCO Black Sea Service (FBSS), now directly connecting Chinese ports with Novorossiysk via the Suez Canal. The service’s import traffic primarily consists of consumer goods, cars and SKD and CKD kits, while exports feature forest products, pulp and paper industry goods, non‑hazardous chemicals, fertilisers, agricultural products, and refrigerated cargo moving in both directions.

2024 achievements in the domestic transportation segment:

- the Company deployed higher‑capacity vessels, resulting in a 3,005 TEU increase (up 20% vs 2023) in loaded container volumes on the Petropavlovsk‑Kamchatsky – Vladivostok (FPKL) route. This fleet modernisation also enabled combined voyages on the Vladivostok–Anadyr–Egvekinot (FADL) and FPKL routes without compromising service reliability and regular schedule integrity, with additional capacity support for the FPKL service;

- the Company upgraded the fleet serving the FESCO Saint‑Petersburg Kaliningrad Line (FSKL), achieving a 49% capacity expansion.

| Indicator | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| International routes, k TEU | 288 | 342 | 419 | 501 | 20 |

| Domestic routes, k TEU | 81 | 84 | 105 | 104 | (1) |

Tramp shipping

FESCO implements a range of logistics solutions for its fleet aimed at project and special shipments. In 2024, operable vessel days totalled 9,162, up 8% YoY.

2024 achievements in project and special shipments:

- FESCO further expanded Northern Sea Route shipments using specialised MPP Multi‑purpose vessel. ‑type vessels between St Petersburg, Arkhangelsk, Pevek, Nakhodka, Southeast Asian countries, and China, transporting over 115 thousand tonnes of general cargo;

- the Company completed seven voyages as part of the Northern Sea Route development programme;

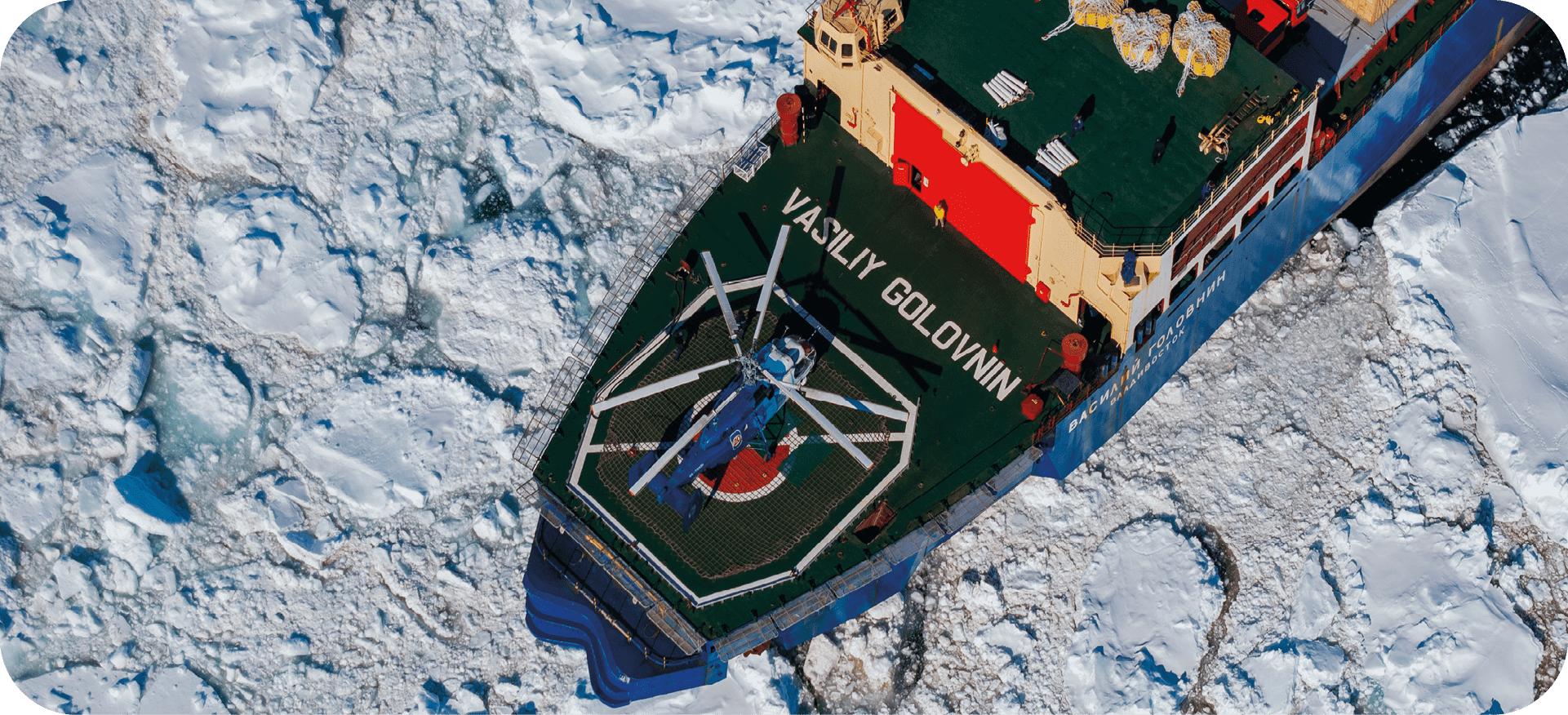

- the Company continued cooperation with India’s National Centre for Polar and Ocean Research (under the Ministry of Earth Sciences): the diesel‑electric ship Vasiliy Golovnin successfully completed its first voyage under a five‑year contract, delivering cargo to India’s Bharati and Maitri research stations.

| Indicator | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| Operable vessel days | 6,236 | 6,931 | 8,470 | 9,162 | 8 |

Photo taken during the 7th Indian research expedition by travel blogger Konstantin Parfenyev (A Place on Earth project).

Intermodal services

FESCO provides domestic and international (export, import, and transit) intermodal container services.

In 2024, FESCO continued to expand its geography by developing existing routes and introducing new services:

- the Company launched a regular FESCO Togliatti Shuttle connecting Vladivostok and Togliatti. The service focuses on the transportation of imported goods arriving at VMTP from East and Southeast Asia to Togliatti and the Volga region;

- complementing the existing FESCO Chelyabinsk Shuttle for imports, the Company introduced an export service from the Formachevo station, enhancing shipment capabilities from the Ural region to VMTP;

- the Company expanded rail services in Russia’s Northwestern region with the launch of the FESCO Komi Shuttle (Syktyvkar to Vladivostok), FESCO Neva Moscow Shuttle (St Petersburg to Moscow), and FESCO Baltic Black Sea Shuttle (St Petersburg to Novorossiysk). To ensure seamless intermodal connectivity, these rail services are integrated with FESCO’s maritime services;

- FESCO launched new services with regular shipments from the Zhigulevskoye More (Togliatti), Orlovka, Sterlitamak, Voinovka, Alapayevsk, Maryanovka, and Barabinsk stations, significantly expanding export cargo capabilities from these regions;

- the Company achieved record shipment volumes in export‑bound land trains, handling 31,678 TEU (up 150% YoY), including an exceptional 1,559% increase in shipments routed through Kazakhstan;

- despite an overall reduction in railway network orders for shipments bound to the Russian Far East, FESCO maintained its export shipment volumes and increased the share of trains used for direct mixed railway and water transportation to 39% (up 8% YoY);

- FESCO introduced its first long high‑speed container trains for export shipments from the Tobolsk station, achieving a 43% increase in container loading capacity per train;

- the growth in import land transportation from China to Russia enabled FESCO to increase its intermodal shipping volumes by 50 % compared to 2023 levels;

- FESCO focused on further boosting its FESCO Asian Land Border (FALB) service sales by introducing through‑transportation from China to the Silikatnaya station with direct coordination with Chinese railway contractors. The Company also established dedicated service trains on the Chongqing–Kolyadichi route (for automotive industry customers) and Xi’an–Novocheboksarsk route;

- the Company launched sales of intermodal services through its agents in Turkey, India, and UAE. These agency sales complement the sales handled by FESCO’s Russian offices;

- FESCO implemented comprehensive supply chain management solutions for two additional import sectors: FESCO Fashion for the textile industry and FESCO Chemical for chemical manufacturers and traders;

- to expand import and export traffic on its FESCO Saint‑Petersburg Kaliningrad Line (FSKL), the Company opened its office in Kaliningrad. This office represents both FESCO and the FSKL service in the Kaliningrad Region while providing full‑range transport and logistics services, including trucking operations using the Group’s own vehicle fleet;

- to expand the Group’s maritime and intermodal services in Vietnam, Malaysia, Thailand, and other Southeast Asian countries, FESCO established a Vietnam‑based subsidiary offering a complete suite of transport and logistics solutions with a focus on maritime and intermodal transportation.

In 2024, FESCO increased its intermodal transportation volumes by 2% compared to 2023 through service enhancements, development of new routes, and growth in overland import and export traffic between China and Russia.

| Indicator | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| Volume, k TEU | 465 | 507 | 625 | 635 | 2 |

Terminal operations

FESCO provides stevedoring, surveyor, and freight forwarding services, including loading and unloading of vessels, railcars, and trucks, using its own terminal network, which comprises:

- VMTP, the largest multi‑purpose port in the Russian Far East, handling a broad variety of cargo types, including containerised, LCL, bulk, and general cargoes, machinery, and heavy‑duty vehicles;

- FESCO Gaydamak Terminal handling general cargoes, grain, construction materials, timber, and vehicles for export/import shipments.

| Indicator | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| Total handling, kt | 13,318 | 13,884 | 13,637 | 13,829 | 1 |

| Container handling, k TEU | 757 | 768 | 859 | 879 | 2 |

| General cargoes handling, kt | 5,195 | 5,138 | 4,328 | 4,429 | 2 |

| Vehicle handling, units | 81,748 | 110,783 | 97,443 | 105,222 | 8 |

| Oil product handling, kt | 389 | 480 | 454 | 451 | (1) |

Heavyweight containers

VMTP set a new container cargo handling record in 2024, processing 879 thousand TEU – 20 thousand TEU more than in 2023. This growth was due to a timely expansion of own assets (containers, fleet, fitting platforms), active cooperation with third‑party sea carriers and freight forwarders, and the implementation of VMTP’s integrated territory development programme.

General and bulk cargoes

In 2024, VMTP increased its general cargo handling by 2% YoY to 4.4 million tonnes. This increase was attributed to higher volumes of metals, coal, and grain handling, along with the launch of ore handling.

Vehicles

Vessel handling (unloading/loading) went down by 17% or 484 units YoY and reached 2,312 units. In 2024, FESCO terminals handled a total of 1,560 vessels vs 1,885 vessels in 2023. The reduction in the number of vessel calls is attributed to the increased capacity of handled vessels.

| Indicator | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| Vessel handling (unloading/loading), units | 1,670 | 2,242 | 2,796 | 2,312 | (17) |

| Vessel calls, units | 1,128 | 1,613 | 1,885 | 1,560 | (17) |

| Average daily fleet handling, kt | 35.42 | 36.72 | 36.12 | 36.55 | 1 |

| Rolling stock handling, k units | 222.0 | 224.4 | 217.5 | 209.6 | (4) |

| Average daily railcar handling, units | 608 | 615 | 596 | 573 | (4) |

Inland terminals

| Container handling | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| Novosibirsk | 101 | 117 | 116 | 118 | 1 |

| Khabarovsk | 52 | 52 | 43 | 20 | (53) |

| Tomsk | 7 | 8 | 9 | 6 | (35) |

| Total | 160 | 177 | 168 | 144 | (14) |

In 2024, inland terminal handling volumes declined by 14% YoY to 144 thousand TEU.

Throughout the year, terminal operations continued to face significant external constraints asscociated with the railway network and prioritisation of shipments with higher priority status under non‑discriminatory railway infrastructure access rules.

To enhance the Group’s operational efficiency, routes going through terminals in Novosibirsk and Khabarovsk were restructured, resulting in:

- increased volumes and share of core regular services from Novosibirsk to Irkutsk, Khabarovsk, and Vladivostok;

- higher containerised cargo volumes from Novosibirsk to Krasnoyarsk Railway stations;

- growth in transit cargo volumes from Moscow and St Petersburg to Novosibirsk;

- an increased share of loaded container handling and higher volumes of loaded container receipt from western routes;

- expanded handling of imported cargo transported from the Russian Far Eastern ports in gondola car trains.

With container handling volumes flat YoY, the restructured cargo flows helped FESCO boost operational efficiency, revenue, commercial activity, and geographic coverage of shipments going through Novosibirsk.

Refrigerated transportation

FESCO dominates the refrigerated transportation market and is the only Russian operator relying entirely on its own assets.

In 2024, we continued to tap into new markets, which yielded the following results in terms of freight turnover:

- a new FESCO Indian Line (FIL) from India to Novorossiysk – 674 TEU;

- a new FESCO Saint‑Petersburg Kaliningrad Line (FSKL) from St Petersburg to Kaliningrad – 962 TEU;

- FESCO Baltorient Line (FBOL) from Southeast Asia to St Petersburg and back – 2,739 TEU.

| Indicator | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| Volume | 11,362 | 17,004 | 20,219 | 28,768 | 42 |

Supply chain management

FESCO Supply Chain provides supply chain management solutions. As a 3PL service provider, FESCO cooperates with a wide range of partners across the globe. We represent freight owners’ interests throughout the transportation process, and ensure cargo delivery, storage, and transfer to consignees using our own and third‑party transportation, warehousing, loading, and other assets and facilities as needed.

In 2024, the Company further developed its logistics services — FESCO Agro, FESCO Air, FESCO LCL, and FESCO Automotive, while expanding FESCO Supply Chain’s domestic and international presence in multimodal transportation for both containerised and non-containerised cargo.

LCL cargo

In 2024, FESCO transported over 31 thousand cu m of LCL cargo, up 19% compared to 2023.

LCL cargo is received, dispatched and processed at warehouses in Russia (Moscow, Vladivostok, Yuzhno‑Sakhalinsk, Petropavlovsk‑Kamchatsky, Magadan) and China (Busan, Shanghai, Ningbo, Rizhao, Yantian). For LCL cargo transportation, FESCO utilises its own logistics assets, including containers, vessels, rolling stock, and trucks. Shipments are primarily performed using the Group’s intermodal, maritime, and rail services, which guarantee priority dispatch for our customers’ LCL cargo. Our LCL transportation solutions include customs clearance, insurance service, responsible storage, cargo consolidation and deconsolidation, and first‑ and last‑mile delivery (door‑to‑door truck transportation from/to customer’s warehouse).

Agricultural cargo transportation (FESCO Agro)

In 2024, the FESCO Agro service delivered 4.2 thousand TEU of agricultural cargo to Asian countries – double the 2023 volume of approximately 2 thousand TEU. Russian exporters most frequently used FESCO Agro for sunflower oil shipments in flexitanks, accounting for over 3 thousand TEU (about 77% of total volume). Other exported Russian agricultural products included rapeseed and soybean oil, beet pulp, flax seeds, peas, and soybean meal.

The FESCO Agro project has broadened its geographical reach. Departures now include container trains from Kazan, Samara, and Chelyabinsk, with deliveries going to Malaysia, Bangladesh, India, and the UAE. The service utilises flexitanks with enhanced technical properties.

Air freight (FESCO Air)

In 2024, FESCO opened its office at Sheremetyevo Airport to operate as a cargo agent for Aeroflot – Russian Airlines, with all requirements for securing an agency agreement being fulfilled.

Customs clearance

In 2024, the number of processed customs declarations (import, transit) increased by 2.5% compared to 2023, demonstrating stable development and growing market share among customs brokers.

FESCO actively participated in industrial projects involving customs clearance of goods based on classification decisions.

Chemical cargo

FESCO continues developing the transportation of chemicals in tank containers on export, import, and domestic routes.

The project is implemented using FESCO’s own services and assets, providing customers with a full range of logistics solutions for domestic shipments as well as export and import transportation to Malaysia, Indonesia, South Korea, India, Kyrgyzstan, Tajikistan, and other countries.

In autumn 2024, FESCO joined the Tank Container Development Alliance (TCDA), the largest international tank container association bringing together over 160 companies

The Group continues to effectively manage its own fleet of tank containers and rotate leased equipment.

Project logistics

FESCO offers turnkey project transportation of bulky and heavyweight cargoes: from receipt at the manufacturing plant to lifting into the mounting position at the destination point. Transportation is fully compliant with the regulatory requirements for transit of cargo along the route, including border crossings.

FESCO’s business priorities include expanding the portfolio of contracts signed with large customers and increasing the share of the market for transportation of heavyweight and oversize cargoes.

Project logistics results in 2024:

- more than 350 thousand tonnes of project cargo were transported;

- the maximum weight of delivered cargo reached 1,250 tonnes; its delivery was performed with a full range of services, including loading and securing on specialised vessels in Chinese ports, transshipment at a port, and transportation by tug‑barge units along the river;

- new types of work were performed to relocate a drilling fluids plant in Sakhalin;

- batches of oversized equipment weighing a total of over 100 thousand tonnes were transported from China to De Kastri and Ust‑Luga, as well as from Vladivostok to Kamchatka and Chukotka by the Company’s own fleet for the needs of developing projects;

- the Company continued managing the cargo terminal of the Akkuyu Nuclear Power Plant under construction in Turkey: over 20 thousand tonnes of oversized and heavyweight equipment were delivered to the construction site, with the maximum weight of delivered equipment standing at 250 tonnes;

- a number of projects were implemented to move and lift heavyweight and oversized cargo into mounting position, assemble and start up process lines at facilities under construction (a total of over 3 thousand tonnes of equipment was assembled at various key facilities).

Bunkering

FESCO provides a full range of oil product services: from fuel purchase and its handling at the Company’s petroleum tank farm to transfer to the tanks of transport vessels at the ports of the Primorye Territory (in particular Vladivostok, Nakhodka, and Vostochny). As a fuel agent, FESCO arranges the supply of oil products to its fleet at foreign ports and renders centralised oil product logistics support to its own companies across Russia. Oil products are purchased from Russian producers and delivered to the destination as well as from regional suppliers and distribution companies and delivered to vessels or land facilities.

In 2024, the Company rendered bunkering services primarily to its own companies.

| Indicator | 2021 | 2022 | 2023 | 2024 | YoY change, % 2024/2023 |

|---|---|---|---|---|---|

| Bunkering volumes | 63 | 98 | 151 | 185 | 22 |