Strategy

Key factors underpinning our strategy from 2024 to 2030

Macro environment

Global economy

- Global economic growth is projected to remain stable at 3.2–3.3% in 2025, with 3.3% growth forecast for 2026.

- Global inflation is expected to decline to 4.2% in 2025 and 3.5% in 2026.

- Inflationary pressures will continue easing gradually, prompting central banks to begin rate cuts.

- Average global economic growth is projected at 3% annually through 2030.

- Moderate global growth will constrain prices in global commodity markets.

- US economic growth will stabilise at 2.1% annually due to slowing demand amid reduced savings and declining fixed investment growth.

- China’s annual GDP growth will slow down to 3.6% by 2028 due to population ageing and declining demographic growth.

- India’s economy will expand (projected 6.6% average annual growth) driven by population growth and strengthening investment appeal.

- Asian and African economies will outpace Europe and America in growth rates.

- New Asian growth leaders will emerge (India and some Southeast Asian nations).

- High market uncertainty persists due to geopolitical tensions in Ukraine and the Middle East.

- In 2024, global economic growth reached 3.2%.

- Emerging markets account for ~ 45% of global GDP.

- New trade restrictions emerged in 2024.

- India’s population (1.426 billion) surpassed China’s (1.425 billion) in 2024.

Russian economy

- Russia’s GDP is expected to grow by 1.6% in 2025 and 1.1% in 2026.

- Long‑term potential GDP growth is forecast in the range of 1.5–2.5%.

- Investment activity in 2025 is projected at 2% (against a high 2024 base), with growth later accelerating to 3% and more.

- Inflation will gradually decline throughout 2025 and 2026. Due to the tight monetary policy and higher than expected year‑end inflation in 2024, the inflation rate is anticipated to reach 7–8% in 2025 before stabilising at the 4% target level from 2026 onward.

- Russia’s economic growth will be driven predominantly by consumer demand and continuing substitution of imported goods and components.

- The recovery in Russia’s export volumes in 2024 and sustained growth in subsequent years will be driven by exporters entering new foreign markets.

- Russian‑Chinese economic integration will continue to strengthen.

- Cooperation with BRICS countries will expand further.

- Russia’s economy grew by 3.9% in 2024.

- The key rate was raised three times in 2024: to 18%, then 19%, and finally 21%.

- Inflation reached 9.52% in 2024.

- Investment growth amounted to 7.8% in 2024.

- Russia maintains its position as the world’s fourth‑largest economy by GDP in PPP terms.

- The slowdown in Russia’s economic growth in 2024 was primarily due to weakened private consumption amid tight monetary policy and elevated inflation.

- In 2025, foreign economic activity will expand. The government has launched an updated national project titled International Cooperation and Exports.

- Forecasts for the Russian economy vary (Bank of Russia: +1.5% in 2025, +2.0% in 2026, +2.5% in 2027; World Bank: +1.6% in 2025, +1.1% in 2026).

- China’s share in Russian exports reached 31% in 2024 (up 1% from 2023), while its share in imports grew from 37% to 39%.

Long‑term trends in container logistics

- Continued expansion of intermodal chain assets by Russian companies.

- New logistics hubs emerging in Russia–China border areas

- Growing multimodal transport share.

- Development of the Northern Sea Route as a potentially year‑round alternative transport corridor.

- Expansion of the North–South transport route operations.

- Continued heavy utilisation of eastbound logistics infrastructure.

- Rising e‑commerce shipment volumes.

- Deployment of proprietary IT solutions for deeper customer integration.

- Growing influence of digital platforms and logistics marketplaces.

- Implementation of digital solutions and automation in transport and warehouse logistics.

- Strengthening market positions in BRICS countries amid Western sanctions.

Global container market

- Global container transportation volumes are projected to grow by about 4% in 2025.

- 2024 disruptions in the Red Sea positively impacted shipping companies’ financial performance.

- Global freight and time‑charter rates remained high for most of 2024 due to the use of longer shipping routes.

- Global implementation of ESG strategies will place additional pressure on regional carriers lacking sufficient resources to transition to greener container vessels.

- Transit through the Suez Canal is expected to resume by the end of 2025.

- An increase in US tariffs is anticipated, which could affect global supply chains.

Russian container market

- Further moderate growth at around 4.2% annually is projected through 2029.

- Export will be the main transportation growth driver, with an anticipated increase in trade with Global South countries (Asia, Africa, and Latin America).

- Imports will dominate shipments (38% of the entire container market), but their share is expected to decline due to high key rates, slow growth in purchasing power, and foreign trade restrictions.

- The import‑export imbalance will drive domestic shipping growth.

- Transit volumes will largely depend on Belarusian cargo flows, while ongoing Red Sea tensions will boost China–Europe transit via Russia.

- Increasing pressure on infrastructure in eastern Russia remains the primary constraint to export growth.

- Existing infrastructure limitations and sanctions will urge logistics companies and freight owners to adopt new transport technologies.

- Further recovery and growth in container shipments to the northwest are anticipated.

- In 2025, Russian export flows will target Southeast Asia, Central Asia, the Middle East, and Africa.

- Transit from Belarus to CIS countries via Russia will keep growing (key cargoes: mineral fertilizers, timber, and wood products).

- New tariff regulations include empty container movement rate hikes: +5 % from 1 January 2025 and another +5 % from 1 January 2026 (with hikes included in the indexed base).

- Russia’s container market grew by 5.8% in 2024 vs 2023.

- The export share reached 27% in 2024 and is expected to rise to 28% by 2029.

- Transit accounted for 9% of Russia’s container market in 2024.

- The railway container transportation market via Russia’s northwestern ports was rebounding (with the Baltic Basin showing the fastest growth in 2024).

- China accounted for 68% of Russia’s container handling in 2024.

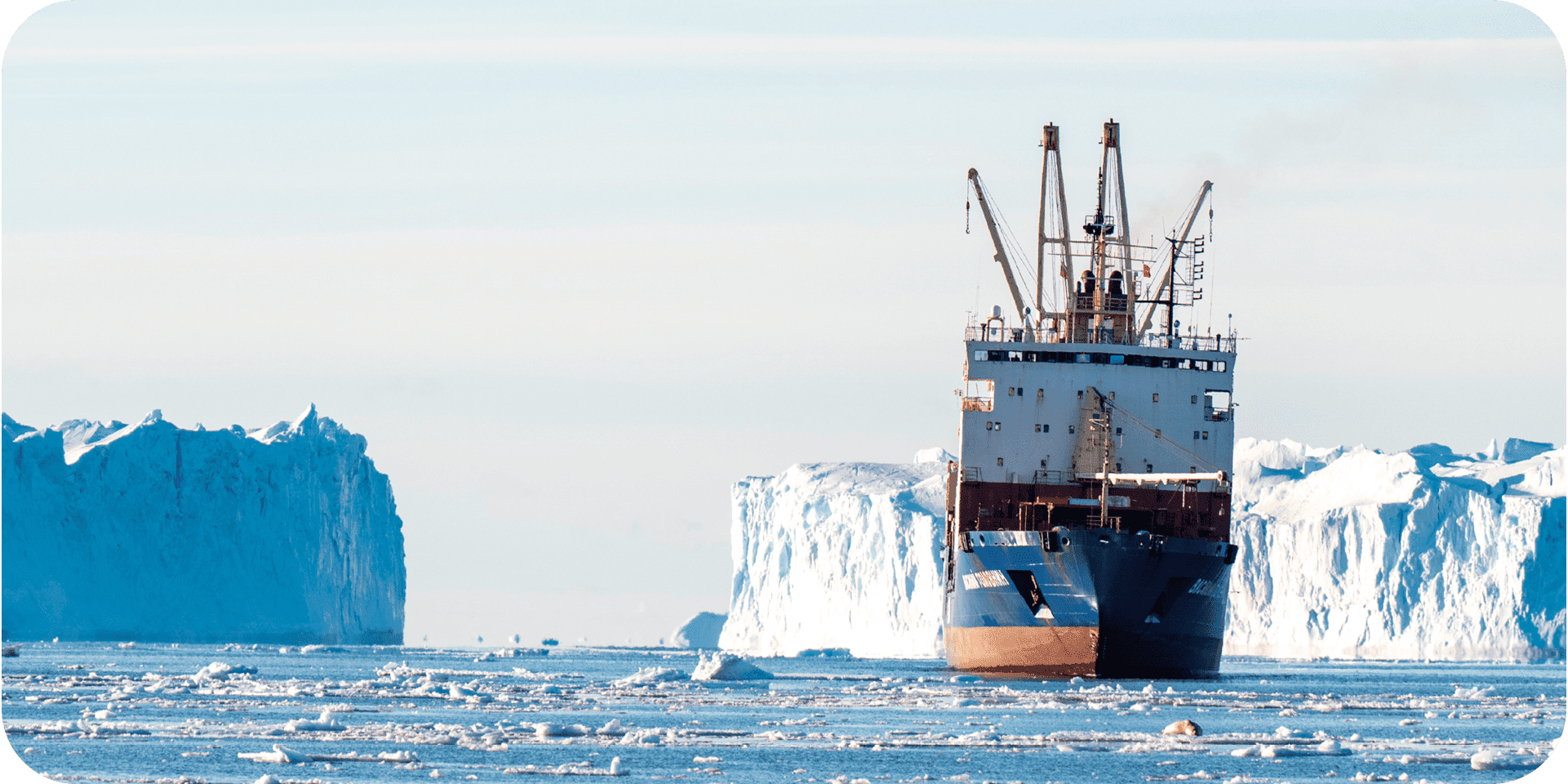

FESCO container vessel en route from China to St Petersburg

Strategy

The key factors affecting FESCO Group’s strategy implementation are geopolitical pressures on Russia’s economy and expanding trade with Asia and Africa.

Target markets

FESCO’s strategic growth markets are Southeast Asia, India, the Middle East, the Black Sea and Mediterranean regions, Africa, and Latin America.

Mission, vision and values

Goal

Drive international expansion by increasing Russian players’ presence in friendly states

Vision

Focus on customers and their needs

Key principles

To encourage better cross‑functional and intra‑Group interactions, we make a continuous effort to improve our business processes through the redesign of our production systems and adoption of lean manufacturing.

Quality service indicators are integrated into our incentive policy. Through continuous system development, we are able to create digital solutions and increase the quality of our services to meet the growing market demand. By investing in business process automation, the Company anticipates an additional economic effect over the strategic planning horizon.

To improve its processes, the Company runs the following projects as a strategic initiative:

- Service Excellence, a project to improve customer experience;

- FESCO’s online services to submit transportation requests and have access to information on a 24/7 basis.

Our people remain at the heart of our business. We strive to provide our employees with all the tools and support they need to achieve their full potential. Attracting and retaining talent remains our core focus.

FESCO consistently engages with Russia’s leading dedicated universities to cultivate a highly conducive environment for nurturing its future talents.

Antarctic expedition.

Photo taken by travel blogger Konstantin Parfenyev (A Place on Earth project).

Expanding our geographic footprint and service offering is key to our strategy. We are committed to providing integrated added‑value services that enable customers to outsource logistics functions worldwide.

These services include:

- multimodal transportation;

- customs clearance;

- warehouse operations, responsible storage and cross‑docking;

- LCL deliveries Less-than-Container Loaded. .

We promote project logistics, which enables the Company to capitalise on its extensive experience in project cargo transportation and build long‑term business relations with EPC contractors and direct customers.

We offer comprehensive logistics solutions to the timber, mining, and agricultural sectors.

Our assets provide a solid foundation to meet our customers’ logistics needs.

FESCO works consistently to:

- expand and upgrade the vessel fleet;

- enhance the efficiency of managing the rolling stock fleet;

- increase the fitting platform fleet to keep its railway container transportation market share and become less sensitive to container transportation market volatility, as well as maintain meaningful presence in that market segment;

- develop its own handling capacity;

- expand and optimise its terminal network across all regions of Russia and beyond.

To capitalise on logistic synergies, Rosatom (FESCO’s controlling shareholder) plans to maximise utilisation of FESCO’s assets, including its existing infrastructure, in the best interests of the entire Rosatom Group.

Key strategic focus areas

The key principles underpinning FESCO’s strategic development until 2030 must align closely with Rosatom’s objectives in the transportation segment. This encompasses FESCO’s participation in the development of new transportation corridors as well as leveraging synergies between FESCO’s and Rosatom’s other transportation assets, including those of the Delo Group.

Terminal network development across our regions of operation

FESCO is building a backbone network of container terminals and logistics parks to strengthen its presence in Russia and the CIS, improve customer experience, and offer high‑margin products.

Key development focus areas are Russia’s Far East, Siberia, the Urals, Moscow, and northwestern regions, as well as border crossings and Kazakhstan.

Investment decisions regarding project implementation will consider leveraging existing infrastructure or Rosatom’s projects with a high degree of completion.

Development of VMTP and FESCO Gaydamak Terminal, FESCO’s stevedoring assets

The anticipated trend of demand shifting from European to Asian products has proven accurate. Ports in the Russian Far East and land border crossings with Russia will remain the main entry points for Asian goods.

In addition to container imports and transit flows, exports are also set to go up until 2030 as new production facilities are commissioned across Russia with a focus on the Asian market.

Given VMTP’s plans to retain its leadership in the Russian Far East and Russia overall, the port of Vladivostok needs to expand its capacities.

Under its development programme until 2028, VMTP plans to:

- remain the leader by container handling among stevedoring companies of Russia and the Russian Far East;

- keep its capacity utilisation levels at 80–90%;

- engage in a set of measures to expand its capacities to 1.2 million TEU by 2028.

The FESCO Gaydamak Terminal development programme envisages expanding terminal capacities for handling general and unitised cargoes, as well as optimising the Company’s capacity structure.

Maritime segment development

The main strategic objectives of FESCO’s maritime segment are:

- maintaining leadership in domestic and international services in the Russian Far East;

- increasing maritime transportation volumes;

- raising the share of new geographies and businesses to 32% of FESCO’s total shipping services;

- improving fleet utilisation efficiency and driving the average vessel age down to under 15 years.

Geographic expansion

With robust quality of logistics solutions in key areas of business, FESCO is well‑positioned to expand its geography by scaling up its expertise and competencies to new regions.

Amid increasing sanctions pressure from the US, trade turnover between Russia and Turkey in 2024 decreased by 7% YoY to USD 52.6 billion.

The container market is expected to reach

Reconfiguration of logistics routes between Southeast Asia and Russia and the resulting increase in traffic through the Russian Far East increases FESCO’s expansion potential in Southeast Asian markets.

Trade volume between Russia and Vietnam in 2024 amounted to

up 24% YoY.

By 2025, the target trade turnover is set to reach

African countries are among Russia’s fastest‑growing trade partners. Egypt remained the leader among African countries by the volume of trade with Russia, followed by Morocco, Tunisia, South Africa, and Senegal.

In 2024, trade turnover between Russia and African nations increased

The goal is to increase bilateral trade to USD 100 billion by 2030. In 2024, Russia became the fourth largest trade partner of India and its second largest importer after China. The development of the International North–South Transport Corridor is expected to provide an additional impetus to the growth of trade between Russia and India.

In 2024, trade turnover between Russia and India grew by 15% to

In 2024, trade between Russia and Uzbekistan increased by 20.5%, reaching a record

Trade with Kazakhstan in 2024 grew by 2.7% to

CIS countries continue to be significant trade partners for Russia.

Growth in the share of sales in the segment of added‑value services

Development of SCMSupply chain management. services and project logistics.

Solidifying our market position

Leveraging synergies between Rosatom’s transportation divisions is essential to FESCO’s strategy implementation.

Expansion tools:

- creating a product range in countries focused on Russia;

- working through agents/representatives;

- setting up corporate offices and engaging in partnerships with local operators;

- putting in place assets (Company‑owned vessels and terminals).

Photo taken by travel blogger Konstantin Parfenyev (A Place on Earth project).

The implementation of FESCO’s long‑term plans and targets involves various risks, some of which are beyond the Company’s control. If materialised, the risks can result in actual events that differ significantly from the expectations set out above.

Macroeconomy

- Risk of major international maritime container shipping players re‑entering the Russian market;

- protectionist government policies;

- declining freight rates

Commercial tools

- Tightening competition;

- systemic limitations;

- maintaining sales culture standards;

- preserving high service quality

Talent acquisition and retention

- Labour market shortages;

- competition for talent with higher‑margin sectors;

- dependence on highly qualified management teams and staff with technical and operational expertise at all organisational levels

Compliance

- Regulations related to taxation, customs, VATValue added tax., and data privacy;

- anti‑monopoly laws;

- sanctions policy

M&A and integration failures

- Integration failures;

- incomplete realisation of synergies;

- high costs;

- failure to achieve cost savings

Infrastructure constraints

- Limitations of the railway network;

- reduced investment programme for railway trasporatation